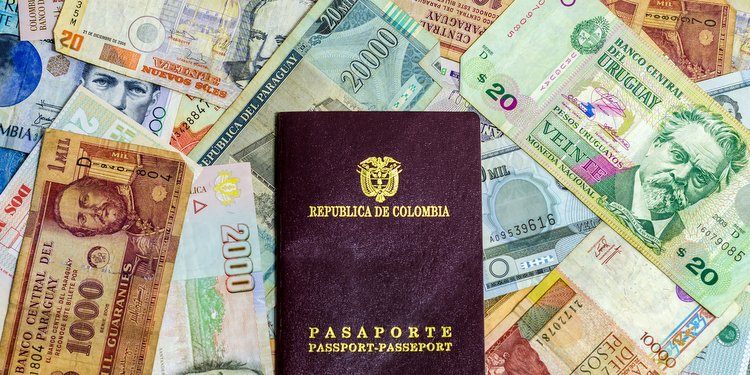

Historically heavily reliant upon exports, the vast majority of South American countries are now considered to be in recession or very close to one. The current strength of the U.S. dollar and a collapse in the price of commodities is placing Latin exports under severe economic strain. In times of expansion, South American economies took on a significant amount of debt, much of which was denominated in U.S. dollars. These same countries now have to use much more of their local currency, eg. pesos, reals and bolivars, to service and clear those debts. Exactly the same circumstances existed in the early 1980s prior to the Latin economic collapse of that period.

As of today, Brazil’s currency, the real, is at an exchange rate of 3.43 to $1 – a 12-year low. With the 7th largest economy in the world, Brazil is heavily reliant upon its export of iron ore, amongst other raw materials, to China. However, the Brazilian government debt will soon hit junk status and their stocks are already in “correction territory” – usually a negative decline of at least 10% to adjust for overvaluation. Many economic forecasters are predicting the worst Brazilian recession for over 25 years based on this information. It’s not just the Brazilian economy that is in peril either – the International Monetary Fund (IMF) has predicted recession for both Argentina and Venezuela this year, respectively Latin America’s 2nd and 3rd largest economies. In fact, Venezuela currently has an inflation rate of 68.5%.

The impending plight of South America is mirroring many economies across the globe. If you believe the U.S. economy, heavily reliant itself on quantitative easing and government debt accumulation, will be drawn into exactly the same scenario, please Like & Share this post.