Jack Bogle has a warning for investors in stocks and bonds but this investment might still help you meet your goals

Legendary investor Jack Bogle has bad news for investors in stocks and bonds, get ready for extremely low returns over the next ten years. Research by the founder of Vanguard and published in the Journal of Portfolio Management forecasts annual returns of just 6% for stocks and 3% for bonds over the next decade.

Worse yet, those returns are in nominal terms and not adjusted for inflation. Even if we assume a low 2% inflation rate, stocks will return just 4% and bonds will barely keep the value of your money intact.

On an average return of 4.5% for stocks and bonds, there is little hope that retirement portfolios will be able to meet your spending needs. There is one investment that might yet help you reach your financial goals in retirement as well as helping to lower your portfolio risk when combined with stocks and bonds.

The Simplest Way to Low Returns in Stocks and Bonds

Bogle published his “Occam’s Razor Redux” paper this month after publishing it first 25 years ago. The idea, as with Occam’s Theorem, is that the simplest method to forecast returns will be the most accurate. Bogle’s first paper, published in 1990, forecast the annual return on the market within 0.2% over the next 12 years.

Forecasting stock market returns, Bogle adds the current dividend yield on the market to the forecast for annualized growth in corporate earnings. He then adjusts this number by an expected change in the market’s price-to-earnings ratio.

It’s an intuitive formula, adding the cash return and an investor’s ownership of profits and then adjusting for market sentiment for stocks. For the next ten years, Bogle estimates a 2% dividend yield plus 4.7% annual earnings growth. The final estimate of 6% return is due to the market’s current P/E coming down to the long-run average of 17.8 times earnings

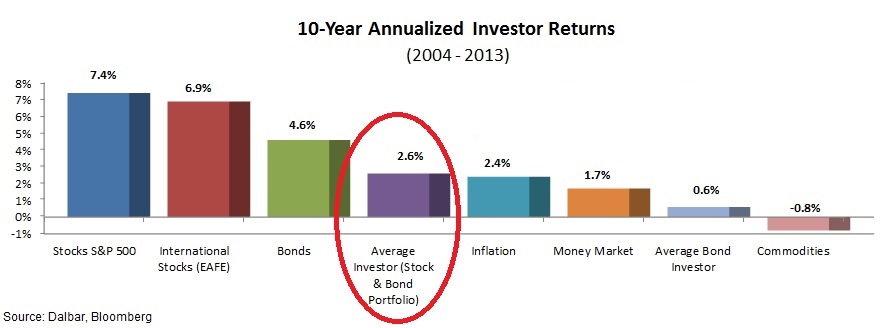

The result would be pretty dismal returns for investors. Over the decade to 2013, stocks averaged a return of 7.6% while bonds produced returns of 4.6% on an annualized basis. The problem is that poor investor behaviors like panic-selling caused investors to seriously under-perform the market with an annual 2.6% return on a 50/50 stocks and bonds portfolio.

Even if investors are able to achieve market returns, Bogle’s forecast would mean an average return of just 4.5% for a blended portfolio and a return of just 2.5% after inflation. Make one mistake with market timing and you could be looking at a lost decade of investing.

The Only Investment that can Save Your Retirement

Fortunately, stocks and bonds are not the only options for your IRA investments. Against the outlook for abysmal returns on stocks and bonds, precious metals may be able to provide enough upside to meet your retirement goals.

Investor demand for gold looks to have returned and could end the multi-year bear market. According to the World Gold Council, investor demand jumped 27% in the third quarter of 2015 with bar and coin demand in the U.S. surging 207% over the quarter. With demand for jewelry and industrial use remaining fairly steady, weak investment demand has largely been blamed for sluggish prices.

Central Banks have been aggressive buyers of gold to protect their assets against the rise in the U.S. dollar and have been net buyers of gold for 19 consecutive months.

As the price per troy ounce fell, miners seriously cut back on capital spending for projects. It’s expected that the supply-demand balance will change dramatically in 2016 with a gold shortage turning prices higher quickly.

It would take very little for gold prices to rebound. From supply-demand imbalances to market volatility, several factors are already lining up in favor of the yellow metal. Not only might gold outperform stocks over the foreseeable future, investment helps to smooth risk in a portfolio through diversification.

Even if investor sentiment for stocks remains strong and the price-earnings multiple shoots to a recent high of 25 times, stocks will only provide an annual return of 9% over the next ten years. Combined with a position in bonds, investors won’t be able to meet their long-term investing goals without adding stronger growth in gold. Most 401k investment options will severely limit your choices for gold investment so it’s critical that you understand IRA transfer rules to take control of your retirement.