Avoid getting taken off-guard by these three worst retirement planning fails with a little preparation

Retirement planning is tough enough without getting blind-sided by unexpected costs or coming up short on your savings. Even the best laid plans can run into unexpected roadblocks but there seems to be a few retirement planning fails that catch almost everyone off-guard.

From taxes to investment returns and an unexpected layoff, make sure you check your own retirement plan for these three stumbling blocks.

Worst Retirement Planning Fails

These aren’t the only retirement planning fails but the ones I see most in plans. The first of these will hit everyone’s retirement though few are planning for it. The other two fails are a matter of bad luck but there are ways to avoid getting hit with the loss.

Retirement Planning Fail #1: Whoops, Forgot about Taxes

Too many retirement savers look to their 401k and IRA balances, thinking they are ready to achieve the goals for which they’ve worked so hard. They’ve worked through the retirement calculators and think they are on track.

It’s too bad that most retirement calculators do not account for the taxes you’ll owe on 401k withdrawals. Even if you avoid withdrawal penalties by waiting until retirement to tap your IRA savings, the tax bite can be over a third of your withdrawal. You’ll need to withdraw more than $53,000 from your account to meet living expenses of $35,000 if you’re in the 35% tax bracket.

When you’re figuring out how much you need to meet retirement spending needs, don’t forget to account for Uncle Sam’s hand in your pocket. Better yet, diversify your tax liability in retirement with a Roth IRA account.

Retirement Planning Fail #2: Market Crash Early in Retirement

The stock market has rebounded 184% from its 2009 low and retirement planners are feeling pretty good about their portfolios. Ask anyone that had planned on retiring in 2008 and you’ll know that it can all change in a heartbeat.

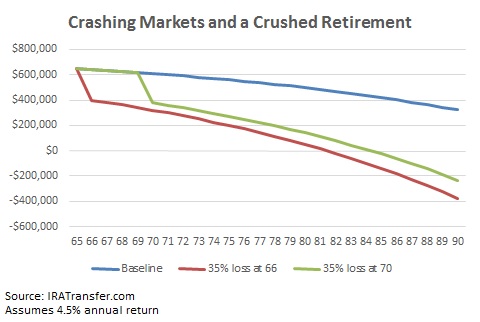

Even retirees with much larger retirement savings can be caught in this retirement planning fail. Assuming a 4.5% annual return, a retirement account of $650,000 will generate $35,000 in annual distributions and still have over $300,000 left by the time you reach 90 years old. Get caught in a market crash, losing 35% of your portfolio and the outlook changes dramatically. Losing 35% at age 66 means bankruptcy by 82 while getting caught in a crash at 70 only pushes retirement failure back to age 85.

We recently featured the Bucket Approach to Retirement Planning which can help avoid some of the worst retirement planning fails, including the problem of market collapse. The approach separates your retirement investments in three different buckets of investments; cash, income-producing, and growth. The approach can help you make it through a sudden drop in assets by relying on the cash and income bucket for spending while letting the growth bucket recover after a market collapse.

Retirement Planning Fail #3: Thought You Would Work Longer

Many retirees are planning on working longer or working from home to make their savings go farther. A recent survey by Bankrate found that 75% of workers plan on working as long as they can though only 39% say it’s because they like to work. A third of those respondents are planning on working into their 70s because they’ll need the money. More than half (55%) say they’re worried about money and how they are going to cover retirement spending needs.

Working in retirement may seem like a cure for not having saved enough but it isn’t always your choice. While you can avoid the two other retirement planning fails through careful planning, this one can really catch you off guard and destroy any hope of reaching your retirement goals.

The Age Discrimination in Employment Act of 1967 (ADEA) is supposed to protect workers age 40 and older from age-based layoffs and other practices. The reality is that it is too easy for employers to rationalize layoffs that target higher-cost employees. Worse still, an employer can ask an employee to waive their rights under the ADEA – something to which the employee may feel obligated to agree as a “team player.”

Besides layoffs, medical reasons can cut your employment plans short in an instant. A debilitating illness will not only remove the regular income but could add to expenses through long-term care and medical costs.

Avoiding the three worst retirement planning fails comes down to a mix of saving more, investing right and planning for different retirement outcomes. Planning for taxes and diversifying with a Roth IRA will help avoid the tax-man running off with your retirement while using the bucket approach can help make it through a stock market selloff. If you plan on working through retirement, plan on different scenarios and what you can do to make up for lost income should a layoff happen.