The Grinch is about to Steal the U.S. Economy

Listening to government officials and stock market analysts, you might get the impression that the economy has jumped ahead nicely these seven years after the meltdown in the financial markets. With unemployment at an 8-year low ahead of the holiday shopping season, you might just think that the economy can weather a start to higher interest rates.

The fact is that the collective wisdom of the Federal Reserve, the government, stock market analysts and nearly the entire investing public is about to get a lump of coal for Christmas. January will be the beginning of the meltdown and investors need to protect their assets before it starts.

The Economy isn’t as Strong as You Think

Take the economic facts together and it’s glaringly obvious that the economy is about to crumble. The government has obscured this reality to escape blame. Investors have blinded themselves in the usual euphoria that comes with every business cycle.

The unemployment rate may indeed be at its lowest in nearly a decade but it is because millions are dropping out of the labor force for lack of work. Labor force participation, those working-age adults employed or looking for a job, is down 4% since 2007. If you count the people that have simply stopped looking for work, the job market looks much less rosy.

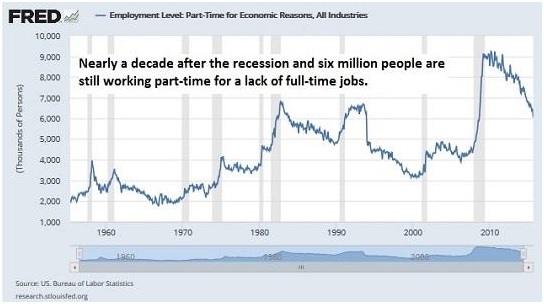

The U.S. population has grown by 20 million people since 2007 yet the labor force has only added 3.3 million people over the period, and only 2.6 million of those new workers have jobs. Six million people report working part-time because their hours have been cut or they can’t find full-time work, more than two million higher than the 2006 data.

Put it all together and employment has never recovered from the collapse of the financial system.

Not only is the job market an illusory lie but those able to find a job are no better off than they were before the crisis. The average hourly earnings of production and non-supervisory workers is up just 0.6% a year since 2007 after adjusting for inflation

Consumer spending drives two-thirds of the economy and retailers are going all-in on this holiday shopping season. The amount of inventory relative to sales at retailers hit a five-year high in August and keeps building as retailers hope for a hot holiday season.

You don’t need a crystal ball to see that shoppers aren’t going to be coming out this year. Disappointing holiday sales will lead to massive losses on the inventory buildup in January. All those part-time jobs, on which the supposed recovery has been based, will disappear and every industry will brace for the start of a new recession.

Possibly worse yet is that the Federal Reserve has backed itself into a corner by not raising rates from historic lows. Chair Yellen and company have pushed back rate increases for so long that they’ll have to raise rates at the December meeting just to keep some shred of credibility.

Rates will start increasing just as the economy starts to wobble. It’ll be a two-punch knockout and traders will rush for the exit on the end to a seven-year bull market.

Protecting Your Assets and Financial Security

There are two things investors need to do to ready their portfolios for the coming collapse. The obvious change will be to assets that will hold up or even gain on the fallout in market prices. Not as obvious but possibly even more important is the need to protect retirement assets from corporate malfeasance and bankruptcy.

Precious metals may be the only refuge for investors over at least the next year. Stocks will obviously plunge but bond investors looking for safety will also be surprised by losses as the Fed raises rates and the prospect of corporate bankruptcies leads to a selloff.

The new budget deal will calls for a 22% increase in employer premiums to the government’s Pension Benefit Guaranty Corporation. That means pension premiums will have surged 151% since 2007. The building insolvency in pension plans, combined with an economic recession, will lead to bankruptcies and workers will take a hit on promised benefits. The only way to protect yourself is by rolling 401k assets into an individual retirement account that you control.

The countdown has already started on the coming economic collapse. Investors have only weeks left before holiday sales numbers start to show the first signs of stress.