Will long-term energy demand make energy stocks good retirement investments once again or do you need to rethink your portfolio?

The price of oil has crashed more than 70% since mid-2014 and has taken energy investments down with it. The revolution in U.S. energy production had a lot of investors relying on the sector to provide strong returns and good retirement investments for decades to come. That idea is being called into question now and investors are scrambling for other investment options.

The Energy Select Sector SPDR ETF (XLE) has plunged more than 25% over the last year and that’s including dividends. In fact, only investors that have held the fund for more than five years are able to say they’ve made money. That’s a far cry from an investment in the S&P 500 which has doubled over the last five years.

Investing in energy over the last ten years would have yielded you a total return of 19% including dividends. That’s not enough to meet your retirement goals and it might get worse before it gets better.

Many investors are wondering if energy stocks still have a place in their retirement investments.

Why Energy Stocks May Still Be Good Retirement Investments

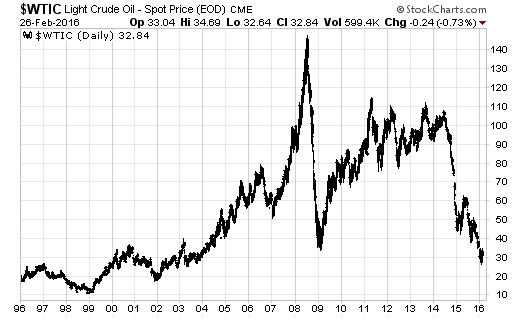

Despite the selloff, there’s good reason to believe that energy stocks might still be good retirement investments. A brief glance at oil prices over the last twenty years shows just how cyclical prices can be and how quickly they can recover. Even if it takes 20 years for oil prices to regain the $100 level, it would still represent a 6% annual return on the current price.

BP paints a positive picture for investors in energy stocks with its 2035 energy outlook report. The integrated oil & gas company estimates global production of oil to increase by an average of just 0.7% over the 20 years to 2035 while consumption will increase by an average 0.85% per year. That difference in supply and demand could mean an annual shortage of 181 million tons of oil equivalent over the next two decades.

There’s little doubt about the need for oil and gas in the future. The current level of fear in the market for oil prices and energy stocks may turn out to be an excellent opportunity.

Why Energy Stocks May Not Be Good Retirement Investments

Despite its history for rebounding prices, there’s one reason to be cautious on energy stocks as retirement investments.

The shale boom in North America has completely changed the game for oil and gas production. It used to be that it took years to produce from a new well or oil field. When higher prices led to a boom in production, supply would surge and bring prices down. Oil companies would then cut spending on field development and oil production would fall with several years of declining supply. Even when prices rose on the declining energy production, it still took years for new wells to start producing and restart the whole cycle again.

It now takes less than a month for shale explorers to drill a new well and they can be producing at capacity within 90 days. That means any increase in oil prices will be met almost immediately with higher oil production. We may never see the spikes in oil prices again like we’ve seen in the past. Instead, oil companies and energy stocks may be in for a new normal of lower prices as suppliers bring oil back to the market every time the price rises marginally.

In this scenario of lower prices, energy stocks may still be good investments but might not be the kind of safety you’re looking for in good retirement investments. There is still a lot of debt coming due for oil & gas explorers put on during the heady days of $100 oil. Unless the price of crude rebounds quickly in the next couple of years, many of the smaller players might not make it.

The best way to lower your risk in energy stocks as retirement investments or elsewhere in your portfolio is to balance them with other real assets. The coming wave of inflation may push prices for real assets higher even if the shale boom keeps a lid on oil prices. Other real assets like gold and silver don’t have the same potential for surging production and will both benefit from the increase in prices. Make sure you understand the benefits of holding precious metals in your retirement portfolio.