SEP IRAs offer some of the best benefits and tax-advantages among retirement savings options. Find out if you are eligible and how to set up an account in this guide to SEP IRAs

Owning your own business is the American dream and if you are one of the ten million self-employed Americans, you are trying to make that happen. You’ve taken the risk of being your own boss and you deserve to reap the rewards.

But is the constant race of being a small business success distracting you from the larger picture? Are you one of the 40% of entrepreneurs, according to U.S. News & World Report, that are not saving for retirement?

Besides setting yourself up for tough financial times in the future, if you are not taking advantage of special savings vehicles for self-employed individuals, you could be paying too much in taxes as well.

Fortunately, both of these problems share a common solution – The Simplified Employee Pension (SEP) IRA. This guide will help you understand this relatively new investment vehicle and explain how you can take advantage of preferential benefits for self-employed individuals. It will compare the plans against other options and try to answer your questions. For more information on SEP IRAs and other retirement options, including one-on-one help in setting up the account that is right for you, call (800) 767-1423.

What is a Simplified Employee Pension SEP IRA?

The SEP IRA is a simplified retirement plan designed for self-employed or small business owners to contribute to their own retirement savings and that of their employees. Before SEP accounts were established by the 1978 Revenue Act, investors had fewer options, and generally preferred Keogh Plans for their higher contribution limits compared to traditional individual retirement accounts.

The SEP IRA removed a lot of the burdensome paperwork involved with a Keogh Plan and increased contribution limits from traditional IRAs. In this way, the SEP IRA is a hybrid plan that encompasses the best benefits of previous options into one investment vehicle for the self-employed and small business owners.

SEP IRAs are similar to traditional individual retirement accounts. They are easily established through most financial intermediaries by completing IRS Form 5305-SEP. The form is not filed with the IRS but simply establishes the plan. You contribute as much as you like to the plan, up to contribution limits, and when you want. Contributions are deducted from your income in the year they are made and grow tax-free until withdrawn in retirement.

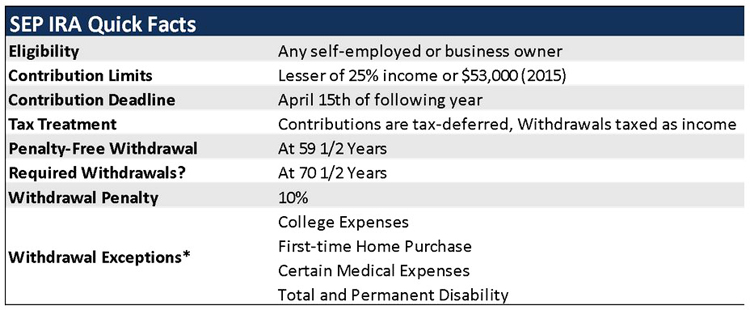

The real power of the SEP IRA comes from its higher contribution limits compared to other plans. You can contribute up to the lesser of 25% of your income or $53,000 (2015). This provides a huge tax savings beyond what is available in a traditional IRA or 401k.

As with most retirement savings accounts, withdrawals from a SEP IRA before you reach 59 ½ years of age may be assessed a 10% penalty and you’ll have to pay income taxes on the amount. There are several exceptions to the withdrawal penalty such as to pay for college expenses, for a first-time home purchase (up to $10,000), for certain medical expenses, or if you become fully and permanently disabled. In these circumstances, you may avoid the 10% penalty but will still pay taxes on the withdrawal as income.

You must start taking distributions once you reach 70 ½ years of age but may continue to make contributions if you are still working.

Am I Eligible for a SEP IRA?

Any employer, including a sole proprietorship, partnership, corporation and non-profit organization, may establish a SEP IRA plan. Any self-employed individual may also establish a plan under their business name and contribute to their own account.

Employees who are 21 years or older that earn at least $600 a year and have worked for the company in three of the last five years are eligible to receive contributions to their account but do not contribute or set up the account themselves.

Don’t I Have Enough Choices for Retirement Accounts?

The many options for retirement savings can get overwhelming but it pays to know the advantages of each and which may be right for your situation. If you are eligible to contribute to a SEP IRA, you would be hard-pressed to find a more advantageous vehicle for your retirement savings.

Contributions to a SEP IRA are deducted from your income in the year made, as with traditional IRAs, and grow tax-deferred until withdrawal. The key advantage to SEP IRAs is that you can contribute a much larger amount each year.

Unlike a Keogh plan for self-employed individuals, SEP IRAs are extremely easy to establish and do not require extensive paperwork or calculations. SEP IRAs do not require a pre-determined and set percentage contribution, as do Keogh money-purchase options, and there is no penalty if you do not contribute during the year.

SEP IRAs can be rolled-over into a traditional IRA or into an employer’s 401k if they accept rollovers. If you continue to be self-employed but take a second job that includes a 401k, you may contribute to both accounts.

Employer contributions to employee plans are deductible as business expenses. Employees do not make contributions to their own account, instead the employer makes the full contribution. If an employee was eligible for SEP contributions and worked during the year, you must still make a contribution to their account even if they are not employed on the last day of the year.

How do I Establish and Manage a SEP IRA?

SEP IRA plans are extremely easy to establish and contributions can be made at any time. You will have until your filing deadline (April 15th) of the following year to make contributions to the previous year. This makes the plan extremely valuable as a tax planning tool, since you will be able to calculate your tax liability depending on how much you contribute.

Employees establish traditional IRAs to which they can receive contributions from the employer’s SEP IRA. Employees are always 100% vested in the contributions made by their employer. If you are contributing to a SEP IRA as a business owner, you must contribute the same percentage in each eligible employee’s account (relative to compensation). Up to $265,000 in employee compensation may be considered for the contribution limits.

Guide to SEP IRAs: Frequently Asked Questions

Why should I choose a SEP IRA over a traditional retirement account?

SEP IRAs have higher contribution limits that traditional individual retirement accounts. The ability to defer taxes on up to $53,000 of income from your business is a powerful tool to reduce taxes and meet your retirement goals.

Are my investments limited in a SEP IRA plan?

Investments in a SEP IRA plan are completely up to your discretion, though you will want to balance risk with your goals. It is typically appropriate to take a little less risk in a retirement account to ensure that your assets grow at a stable pace to your retirement.

Can I take a loan out on my SEP balance like I do with other retirement accounts?

Loans are not available on SEP IRA balances. You can withdraw money but will generally pay a 10% penalty and income taxes if done before you are 59 ½ years old.

When must I withdraw money from my SEP IRA?

Distributions must start when you reach 70 ½ years of age or anytime after 59 ½. You may continue to contribute to your SEP IRA after 70 ½ if you are still working, but must also take distributions.

Must I contribute every year to my SEP IRA plan?

No, there are no contribution requirements or annual filing with the IRS. You simply contribute as much as you like, up to the lesser of 25% of income or $53,000 each year.