Don’t let a false sense of security ruin your retirement. Understand your options with self-directed IRA investments.

A false sense of security in 401k and other retirement savings may be about to leave retirees with much less than they expected. From pensions to 401k accounts and social security, investors are relying on their hard-earned savings to meet retirement goals but risks in these accounts may be just over the horizon.

With the U.S. government more than $18 trillion in debt to foreign governments, citizens and other investors, all financial assets are potentially at risk. There’s more than $3.7 trillion held in 401k plans and other employer-sponsored retirement accounts. It may not be a popular move but nationalizing some of this money may be the only way for the government to dig itself out of the red. At the very least, you are sure to see ever higher taxes and fees layered on any 401k account and other retirement investments.

Premiums for employer pension plans to the Pension Benefit Guaranty Corporation (PBGC) have tripled over the last 14 years and many companies are looking at ways to ditch their plans. The PBGC has admitted that it will run out of funds by 2022, putting all pensions it guarantees in serious jeopardy.

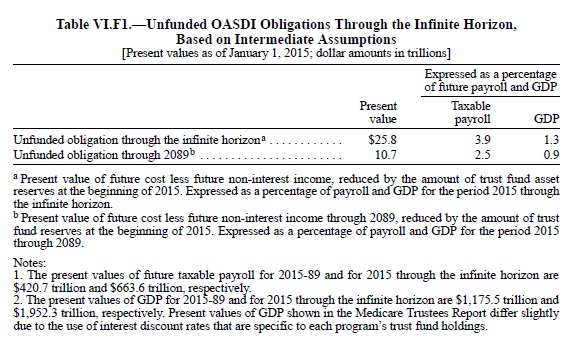

Even as the pace of social security benefits fails to keep up with inflation, the system is seriously underfunded and won’t be able to make future promises. Hidden deep within the 2015 Trustees report on Social Security is table VI.F1 on page 197. It shows the system underfunded by almost $26 trillion on a present value. The SSI system is underfunded by 32% and there is little doubt that cuts will be made in the amount you receive in retirement.

The only way to truly control your financial destiny is through self-directed IRA investments.

Self-Directed IRA Investments

The name, Self-Directed IRA, may be a little misleading. While you control the investments in which you put your money and may even have a checkbook on the account, you cannot actually have possession of the funds according to IRS rules.

Transferring your 401k or other retirement accounts to an IRA must be done according to strict IRA transfer rules but the process is fairly simple for a plan provider. Your IRA trustee will be the one taking possession of funds from the old account so you do not trigger any withdrawal penalties or taxes.

Besides control over your retirement assets, you’ve got more options when it comes to self-directed IRA investments. While company policy may restrict your 401k plan to a short list of mutual funds with expensive fees, there are very few limits to the investment options in self-directed IRA plans.

We put together a full list of IRA investment options on this page.

- Traditional investments like stocks, bonds, and CDs

- Precious metals investments in gold coins and silver

- Real estate investments in property and mortgagaes

- Businesses, private equity and loans

How Safe are My Self Directed IRA Investments?

It’s important to research your new provider that will hold your self-directed IRA investments. Among the different options; you can choose traditional investment firms, banks and credit unions or alternative asset IRA custodians.

Traditional investment firms and banks may limit you options for self-directed IRA investments to products they provide like stocks and bond trading. Alternative asset custodians are generally more flexible and will allow you to hold gold, silver, real estate and other assets.

Most self-directed IRA custodians will be in good shape financially but you do need to choose a provider that can provide the security and guidance you can trust. Make sure you select a firm with non-commissioned IRA advisors to help you with the process so you know you are not being guided to investments with expensive fees. Don’t let your financial security remain at risk, take control of your money.

Click through to learn the complete process to transfer 401k assets to an IRA.